Both prices and trading volumes on the Palestine Stock Exchange (PEX) have scored impressive gains since the start of this year, thanks largely to investors from the Palestinian diaspora and Arab Gulf states. Recent decisions by such respected ratings agencies as Standard & Poor’s, Dow Jones and MSCI to include Palestine in their indices, as well as plans by London’s FTSE to follow suit, are now attracting other global investors from the UK, Europe, the US, Canada, Chile and elsewhere to the Exchange and to its leading companies, such as PADICO Holding, PalTel and the Bank of Palestine, analysts report.

Expectations that these moves will be followed by PEX’s inclusion in the global ‘Frontier Market’ indices is already fuelling demand from institutional investors, the analysts add. Its multi-currency platform, allowing trading in both US dollars and Jordanian dinars, as well as Palestine’s lack of capital controls, is also encouraging international interest. Trading volumes in January were more than two-fold higher than in December, and nearly four times as high as in January, 2013.

PEX’s CEO, Ahmad Aweidah, expects 2014 to be a “threshold year.” Photo: Mark Green, mark@nwmsltd.com.

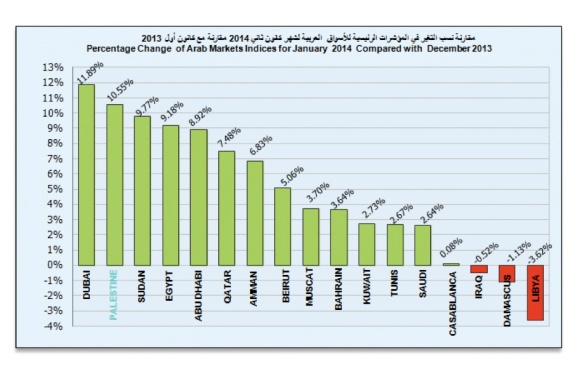

The Exchange’s Al Quds index broke through the 600 barrier in early February before falling back slightly on profit taking. It had risen 10.55 per cent in January alone, making it the second best performing stock market in the Arab world so far this year. Last year, the index registered an annual gain of 13.4 per cent, according to figures compiled by Ramallah-based brokers Sahem Investment and Trading. By the middle of February, the Exchange’s total market capitalisation had reached more than $3.5 billion.

This year could be a “threshold year,” the Exchange’s CEO, Ahmad Aweidah, told InvestPalestine.com. Speaking during a visit to London in mid-January to mark Palestine Capital Markets Day, he said “We are now achieving a series of important economic breakthroughs that could see our growth accelerate even more strongly.

He and other members of the Palestinian delegation, which included senior executives from PalTrade, PalTel, the Palestine Investment Fund (PIF), PADICO Holding, the Bank of Palestine, Sahem Trading & Investment and Lotus for Financial Investment, as well as Abeer Odeh, CEO of the Palestine Capital Market Authority, were hosted on the last evening of their visit to London by Baroness Morris of Bolton, UK Prime Minister David Cameron’sTrade Envoy for the Palestinian Territories, at a reception in Westminster organised by the Palestine British Business Council and its co-chairman, Antoine Mattar.

The Palestine Delegation to Palestine Capital Markets Day in London, 17 January, 2014. From left to right: Fida Musleh-Azar, PEX Manager of Public Relations & Investor Education; PEX CEO Ahmad Aweidah; Ammar Aker, CEO, PalTel; John Davies, Vice-President, S&P Dow Jones Indices. Photo: Mark Green.

Financial services, banking, ICT, infrastructure and high value agriculture, as well as tourism (including such world renowned attractions as Bethlehem, the Dead Sea and Jericho) were making strong progress, Aweidah told an audience of existing and potential investors. And, although economic growth has slowed recently as local entrepreneurs and international donors await firm progress on US Secretary of State John Kerry’s ‘peace initiative,’ Palestine’s GDP has grown by a remarkable 8.4 per cent a year on average during the past five years, he noted.

“The Palestine economy continues to demonstrate exceptional endurance despite political challenges,” Aweidah explained, a performance he attributed to the “strong and vibrant private sector,” its “well regulated and sophisticated financial system,” its “modern capital market,” and “advanced investor protection regime.” The majority of the 49 stocks on the Exchange, he pointed out, also “enjoy free float ratios that are comparable to advanced markets” as well as “reassuring turnover ratios.”

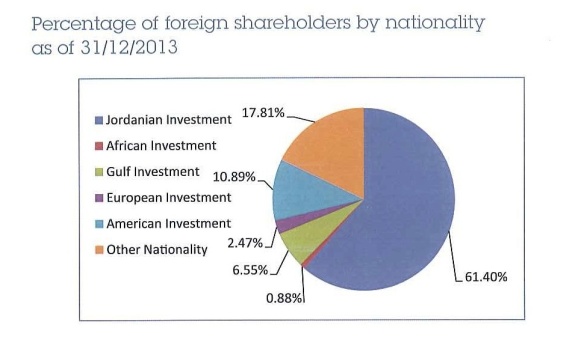

Foreign investors, both individual and institutional, are helping to boost both values and volumes on the Palestine Stock Exchange. Graph: PEX, Ministry of National Economy.

At the end of 2013, foreign investment in PEX amounted to just over 40 per cent of the total value of its shares, or about 34 per cent by volume. Investors from Jordan, many of whom are Palestinians with Jordanian citizenship, accounted for the majority of the foreign shareholders, 61.4 per cent, followed by others from the Americas at 10.9 per cent, the Arab Gulf with 6.6 per cent and Europe with 2.5 per cent. Palestinians made up 95 per cent of the total number of investors, demonstrating the widespread appetite for shares among smaller shareholders living both inside and outside Palestine.

Speaking to potential investors in London and to InvestPalestine.com, John Davies, Vice President at S&P Dow Jones Indices, explained why his firm, which now includes both the respected ratings agencies, Standard & Poor’s and Dow Jones, had established two stand-alone indices for Palestine last December. “We don’t build indices simply because we feel they are needed,” he insisted. “We build them because our clients are asking for them. The establishment [of the new indices] is evidence that there is significant demand for investment in Palestine.”

John Davies, Vice President at S&P Dow Jones Indices, explaining PEX’s attractions to an audience of investors in London, 17 January, 2014. Photo: Mark Green.

The two new additions are the S&P Palestine Broad Market Index (BMI), which aims to capture at least 80 per cent of PEX’s market capitalisation, and the Dow Jones Palestine Total Stock Market Index (TSM), which aims for 95 per cent of the Exchange’s float-adjusted market capitalisation, Davies explained. Since testing began in September 2012, he added, the stand alone BMI index had achieved a 41 per cent cumulative annual return, a figure which compares favourably with the Pan-Arab Composition Index at 24.5 per cent and the S&P Composition Index at about 30.2 per cent.

Despite general skepticism about the progress of Kerry’s peace talks, investors are more confident that he will succeed in brokering a deal, the news agency, Bloomberg, quoted Aweidah as saying in mid-January. “If there’s a framework agreement, it’ll be a game changer” for the Exchange. There’s certainly a lot of optimism in the market about the direction of the political negotiations…. The time to invest in Palestinian stocks is now.”

Processing premium quality Medjool dates at a Palestinian-owned factory in the Jordan Valley. The possibility of greater access to the fertile soil and water of the Israeli-occupied parts of the Valley and “Area C” as a result of the current negotiations between Israel and the Palestinian Authority is a major factor in encouraging both local and foreign entrepreneurs to invest in the West Bank. Photo: fablenaturals.com.

Success in the talks would, according to a recent study by the International Monetary Fund, boost economic growth in the Territories by 35 per cent over the next five and a half years, or about 6.5% a year on average, compared with 1.5 per cent in 2013. This includes Palestinians gaining control of the land, water and resources in Area C, which forms almost two-thirds of the West Bank, which is currently under Israeli military occupation. The IMF adds that an agreement would significantly reduce the Palestinian Authority’s dependence on foreign aid, greatly enhance employment and lower poverty levels. Local entrepreneurs are investing in modern factories, like this one outside Hebron. Photo: Palden Jenkins, paldywan.blogspot.co.uk.

Local entrepreneurs are investing in modern factories, like this one outside Hebron. Photo: Palden Jenkins, paldywan.blogspot.co.uk.

Business confidence in the West Bank is also rising, according to Palestinian analysts, because of higher optimism among entrepreneurs and in the industrial sector, especially in food, textiles, chemical, pharmaceutical, engineering, plastics and construction. The Palestinian Monetary Authority reported in mid-February that its monthly index, the PMA Business Cycle Indicator, had risen from minus 1.44 in the West Bank in January to a positive 8.25 in February. Negative business sentiment in the Gaza Strip also improved, as industrialists reportedly felt more optimistic about the continuous US efforts to stimulate the peace process between Palestinians and Israelis and less fearful of a continuing deterioration in security conditions. The northern West Bank city of Jenin is to be the site of a vital new power plant due to be built by a Palestinian company. Photo: Palden Jenkins, paldywan.blogspot.co.uk.

The northern West Bank city of Jenin is to be the site of a vital new power plant due to be built by a Palestinian company. Photo: Palden Jenkins, paldywan.blogspot.co.uk.

If an accord is agreed, Aweidah revealed, as many as four family-owned businesses in Palestine may also opt to sell shares on the Exchange through initial public offerings (IPO’s). The Palestine Power Generating Company (PPGC), he added, could follow suit.

PPGC is planning to build a $300 million power plant in Jenin in the West Bank which will be fuelled by gas from the giant offshore Leviathan field in the Mediterranean under a $1.2 billion, 20-year deal agreed in January. PPGC’s leading shareholders include the Palestine Electric Company, the builders of Palestine’s first independent power plant, and the industrial conglomerate, PADICO, both of which are quoted on the PEX.

© Pamela Ann Smith

This is a publication of investpalestine.wordpress.com and is protected by international copyright laws. This article is for the reader’s personal use only, but may be re-distributed electronically with a credit to investpalestine.com.